Why Software for Compliance Management ?

Cost of compliance is far cheaper than cost of non-compliance. You could loose your identity if you don’t comply with law of land. In India, every business needs to comply with many regulations including :

1. Income tax compliance

2. GST Compliance

3. Shop & Establishment Act Compliance

4. Provident Fund Compliance

5. Professional Tax Compliance

6. Factories Act Compliance

7. Reserve Bank of India Compliance (RBI Compliance)

8. SEBI compliance

9. Listing Compliance / LODR Compliance

10. Companies Act Compliance / MCA Compliance

11. LLP Compliance

12. FSSAI compliance

13. Insurance Compliance / IRDA Compliance

14. Contract Labour Act Compliance

15. Labour Compliance

16. Factory Compliance

17. Fire Compliance

18. Water Compliance

19. Pollution Compliance

20. Secretarial Standard Compliance

21. Road Safety Compliance

22. Warehousing Compliance

And within these regulations there are more than 100 compliances under each regulations. Its humanly impossible to remember every compliance and with growing businesses and multiple people responsible for compliances its critical that businesses go for compliance software to avoid risk of missing out any compliance resulting in financial penalty, loss of business, loss of reputation and in extreme cases imprisonment for non-compliance.

India is a federal country that thereby makes the Statutory Compliances split into Central and State compliances as well. As the business complexity is increasing and significant initiatives by Government towards digital compliances and online filings, its impossible to follow the traditional route of managing compliance and regulatory filing function with the use of excel sheet or noting down in diaries. In addition, the amount of compliances has been increasing with passage of time over years, thereby creating an additional burden for all type of businesses to comply with these ever increasing compliances.

Therefore, all forms of entities viz. Companies, Firms, Proprietorships, etc have to spend a considerable amount of time complying with the laws of the land.

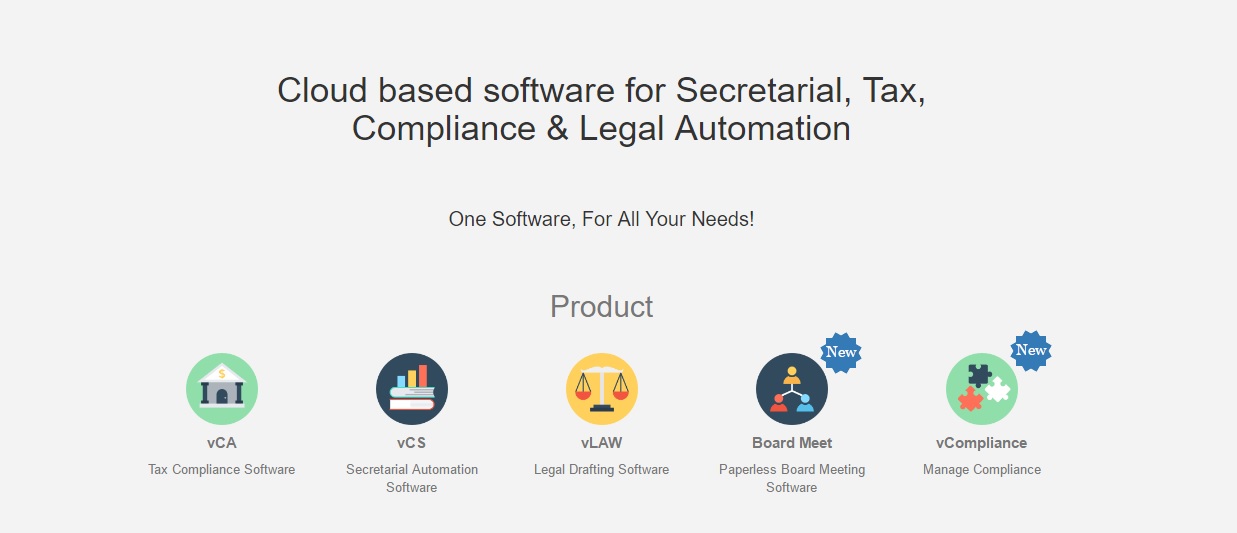

Volody software products are well designed and made for corporates and practicing professionals to run their businesses with no fear of missing any compliance or error in any secretarial, legal, tax or compliance management.

These products includes :

- Preparation of Corporate Records (Minutes, Agenda, Notices)

- Auto Preparation of MCA forms

- Filing of MCA forms

- Auto Preparation of Company incorporation documents

- Secretarial Standard Audit

- Auto Preparation of Registers

- Access to all important regulations, acts & rules

- Centralized & Organized storage of data

- * Word download facility

- * Compliance Management System

- * Document upload & storage facility

- Communicate with all stakeholders

- Web based application

- Share Notices, Minutes, Agenda with Board Members and stakeholders

- Comments facility for Board members

- Calander scheduling

- Secured documents flow

- Editing, Notifications

- Anywhere access to Board folders

- Auto sync to all devices

- Organization wide management of all compliances

- Listing of all compliances for various acts applicable to your entity

- Responsibility matrix of all users responsible for ensuring compliances

- Reminder emails to all users before the deadline to ensure no compliance is missed

- Escalation to seniors so that any non-compliance gets escalated

- Dashboard to see compliance score card

- Availability of various acts

- Communicate with all stakeholders

- Listing of all open & closed legal cases / litigations in various courts

- Admin function to allocate / assign work to team member

- Information on other party names

- Information on cause of litigation

- Information on advocate of other party

- Information on department responsible

- Information on Legal Team responsible

- Information on Advocate handling the case

- Cost of each hearing and money spend details

- Information on development of the case in past and future dates

- Reminder to all concerned for next date of case, reminder for updating proceeding of past date

- Information of relevant section, law being applied while filing the case

- Information to insert details of past judgement of similar cases

- Information on name of court and name of judge

- excel upload facility

- excel / word / pdf download facility

- Dashboard giving MIS / info on cases

- MIS reports / Financial MIS on possible liability or money incurred on case or overall spend

- Listing of all open & closed contracts / agreements signed by the company

- Admin function to allocate / assign work to team member

- Information on department responsible (Business / HR / Technology) within the Company

- Information on Legal Team responsible (name, contact number, email id)

- Information on Law firm part of drafting or vetting, if any (name, contact number, email id)

- Spend on legal drafting

- Information on indemnity clause

- Information on maximum liability

- Start date of the contract

- Expiry date of contract

- Reminder to all concerned for expiry of the contract (you can set reminder date with 30 days / 60 days etc)

- Escalation reminders to seniors in case the contract is not getting renewed

- Update field for users to provide update on legal agreement renewal

- Commercial terms of the agreement

- Information on name, email, contact number of other party in the contract agreement

- excel upload facility

- excel download facility

- Dashboard giving MIS / info on all agreements

- MIS reports / Financial MIS on possible liability or money incurred in drafting legal contracts from external law firm

- 1. Simple utility to prepare Income tax return.

- 2. Auto tax computation.

- 3. Know TDS thresholds on single click

- 4. Prepare and file TDS return in 5 simple steps.

- 5. Prepare TDS return via simple excel upload utility.

- 6. No need to download challan csi file and FVU validation.

- 7. Prepare revised TDS return in only 4 steps.

- 8. Save all your registration, calculation and return of all types of taxes in one place.

- 9. Upcoming module – GST

Cloud based Business Management Software

- Internal Task allocation / Operations Management

- Managing customer leads

- Sending proposals

- Customer interactions (email / chats with customers)

- Customer Invoicing

- Collection update

- Employee performance management

- Customer profitability / business unit profitability

- Email Management with employees

- Project Management

- Accounting of revenue and collection

- Business MIS as per your need

Legal Agreement Drafting Software

- Preparation of legal agreements

- Preparation of Due Diligence reports

- Creation of Case Notes

- Centralized & Organized storage of data

- * Word download facility

Comments

Post a Comment